Uncategorized

Resolving Conflicts Between Tenants: Mediation Tips for Managers

Tenant conflict is an unavoidable aspect of property management, yet unresolved disagreements between tenants can have a devastating impact on community harmony, such as issues over noise levels, shared space etiquette, or lifestyle differences. Your role as property manager should not only focus on maintaining your property but also creating an amicable atmosphere; mediation is…

Read MoreThe Art of Negotiation in Property Management

Successful real estate property management requires more than collecting rents and maintaining buildings. Negotiation is one of the key skills a property manager needs in today’s highly competitive real estate market. Successful negotiation skills can have a tremendous impact on operational efficiency, tenant satisfaction, and profitability. It is therefore imperative to know how to approach…

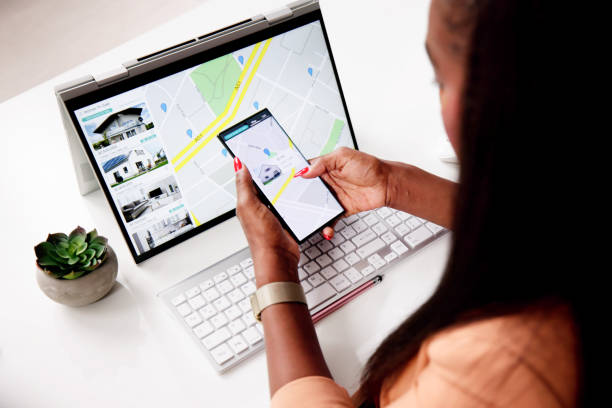

Read MoreAdopting Proptech for Property Management Efficiency

Proptech (property technology) has revolutionized how the real estate industry works. This is particularly evident within property management operations. Proptech adoption is essential to increasing efficiency, profitability, and scalability within property operations; meeting tenants’ tech-savvy demands while simultaneously cutting costs and improving service quality is something Proptech enables. This article investigates how prop-tech is revolutionizing…

Read MoreMaintaining Rental Property Value: Proactive Strategies

Renting property at a high value is essential to attracting good tenants and realizing long-term profits. Property values are determined not only by market forces, but also by how well it is managed, maintained, and upgraded over time. Adopting proactive strategies will allow property managers and landlords to preserve and enhance the value of their…

Read MoreTechnology Integration in Property Management: Key Challenges and Effective Solutions

Integration of technology into property management can be transformative in today’s fast-paced digital environment, increasing efficiency, cost savings, and tenant satisfaction. While its benefits may be obvious, many property managers still face barriers when adopting new technology, from outdated infrastructure to staff resistance. This article focuses on these challenges property managers face when adopting new…

Read MoreHow to Develop a Reliable Emergency Response Plan for Your Property

Emergency response plans are vitally important in protecting people, limiting damage, and maintaining business continuity during unexpected events. Not only is having an organized plan beneficial but often laws or insurance require it. An actionable emergency response plan can reduce anxiety in emergencies from natural disasters to power outages to security threats. Conducting an in-depth…

Read MoreThe Psychology of Property Presentation: Maximizing Appeal

Understanding the psychology of property presentation in today’s competitive market is critical to maximizing appeal and securing faster, higher-value sales or rentals. First impressions matter because potential buyers and renters make emotional decisions within seconds after viewing a property; property managers, real estate agents, and homeowners who understand basic psychological principles can present their spaces…

Read MoreHow Behavioral Economics Influences Property Management Decisions

Real estate has increasingly come to rely on behavioral economics – an emerging discipline that blends psychology and economics – as its relevance grows for property managers and owners. Understanding how people make decisions often irrationally due to cognitive biases helps property managers make more informed choices that benefit tenants and owners alike. With human…

Read MoreReducing Liability with Effective Property Management Insurance

Property management encompasses an array of responsibilities, from maintaining buildings and collecting rent to dealing with tenant issues and complying with local regulations. One of the most vital but often neglected components of this work is risk management; daily exposure to legal and financial risks often requires property owners/managers to purchase insurance to mitigate liability…

Read MoreBlending Hospitality and Property Management: A New Industry Standard

Modern property management and traditional hospitality are increasingly merging in today’s dynamic real estate and rental markets, as guest expectations for elevated experiences change and expectations rise. This convergence is especially prominent in multifamily and luxury developments where guests and tenants alike desire more than a simple place to reside; they demand an exceptional, service-focused…

Read More